(日本語翻訳はこちら)

In this article, I will explain how to earn money outside of virtual currency trading using Binance, one of the largest virtual currency exchanges.

Many people may have an image of virtual currencies as being similar to gambling due to their high volatility (range of price movements).

However, there are various financial models for virtual currencies, such as lending using virtual currencies, as well as whether the value of the virtual currency itself rises or falls.

Some of these financial models are structured in such a way that virtual currency owners can participate and be rewarded.

I will use Binance’s service as an example to show how this kind of system can be used to generate revenue.

What is Binance?

I’m sure some of you reading this article already have virtual currencies or use Binance, so I’ll explain briefly.

Binance is one of the largest virtual currency exchanges in the world.

Here are some simple advantages and disadvantages of using this exchange.

Advantages of Binance

Binance has the world’s highest trading volume.

It differs from CoinBase in that it has a wide range of language support and a large number of users around the world.

It has many users in Japan and China, the world’s No. 1 and No. 3 in terms of virtual currency trading volume, and its trading volume is more than five times that of CoinBase.

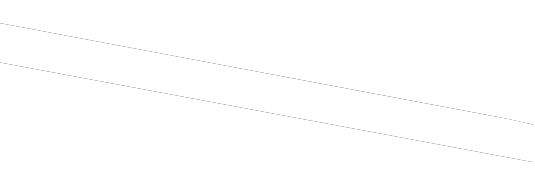

Instant deposit

When purchasing virtual currency, the advantage is that you can use credit cards and agency payments in addition to bank deposits, as shown below.

There are many options other than bank deposits.

Many exchanges only offer bank deposits (net banking accepted) or convenience store payments, which can be time-consuming when you want to make an immediate deposit.

In contrast, credit card payments can be made instantly.

Wide range of currencies and services such as futures, options, DeFi and API

There are so many currencies available. Not only that, but there are some currencies that will be launched for the first time on Binance, and these currencies will be available upon launch from the “LaunchPad“.

There are also many options for trading such as futures and options trading.

In addition, DeFi, which I’ll introduce later, offers a Binance API and a wide variety of other services.

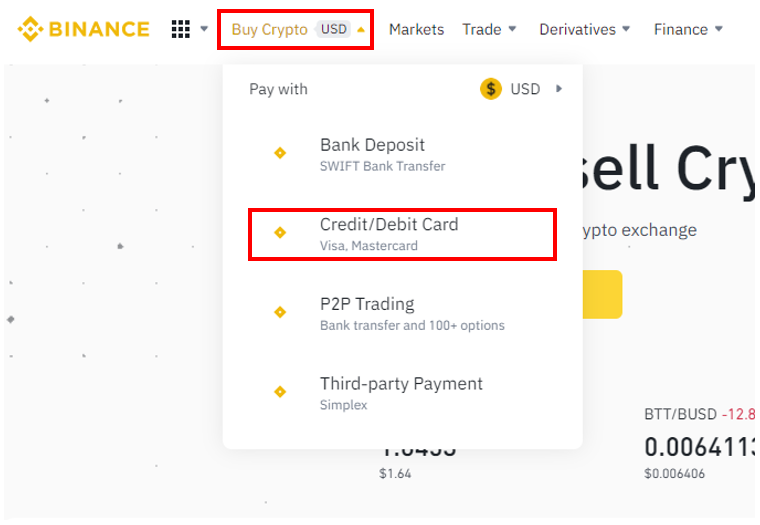

Many currency options for withdrawals

You can withdraw in 27 different currencies including USD and EUR.

If you are interested in Binance

If you are interested in using Binance based on the above, please click here.

Revenue with Binance’s DeFi

Then, the main subject is from here.

As of 2021, Binance has the following ways to target revenue other than increasing the value of the virtual currency itself.

- Flexible Savings

- Locked Staking

- High Risk Products

Flexible Savings

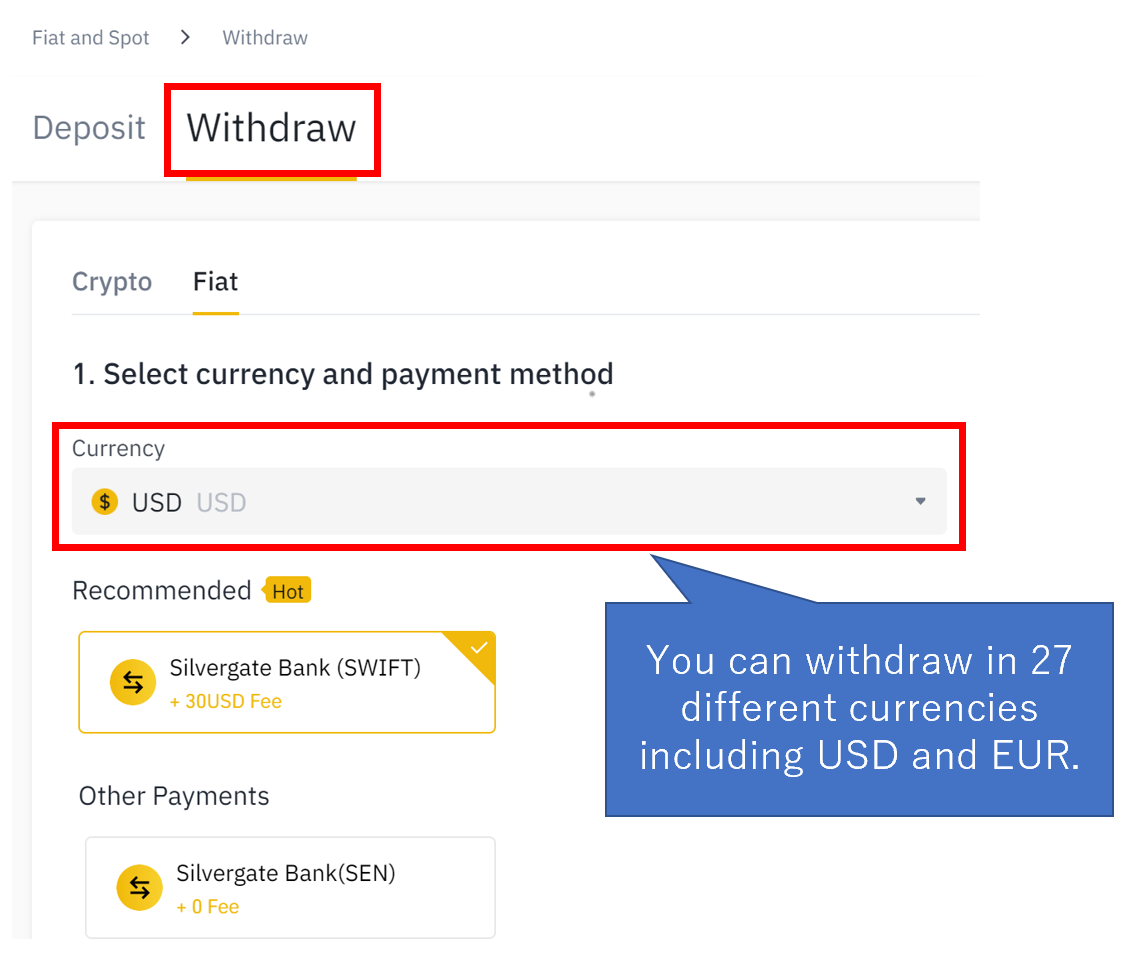

Flexible Savings is a service that allows you to deposit your virtual currency with Binance and get paid for it in real-time.

Currently, there are three services available.

- Flexible Savings

- Launch Pool

- BNB Vault

Flexible Savings allows you to take out your deposited virtual currency immediately at any time.

This allows for flexibility in situations where you want to sell your virtual currency immediately.

flexible savings

Currently, 58 currencies can be deposited. In addition to the above examples, ETH, IOST, EOS, and DOGE are also available. (Click here to see all available currencies)

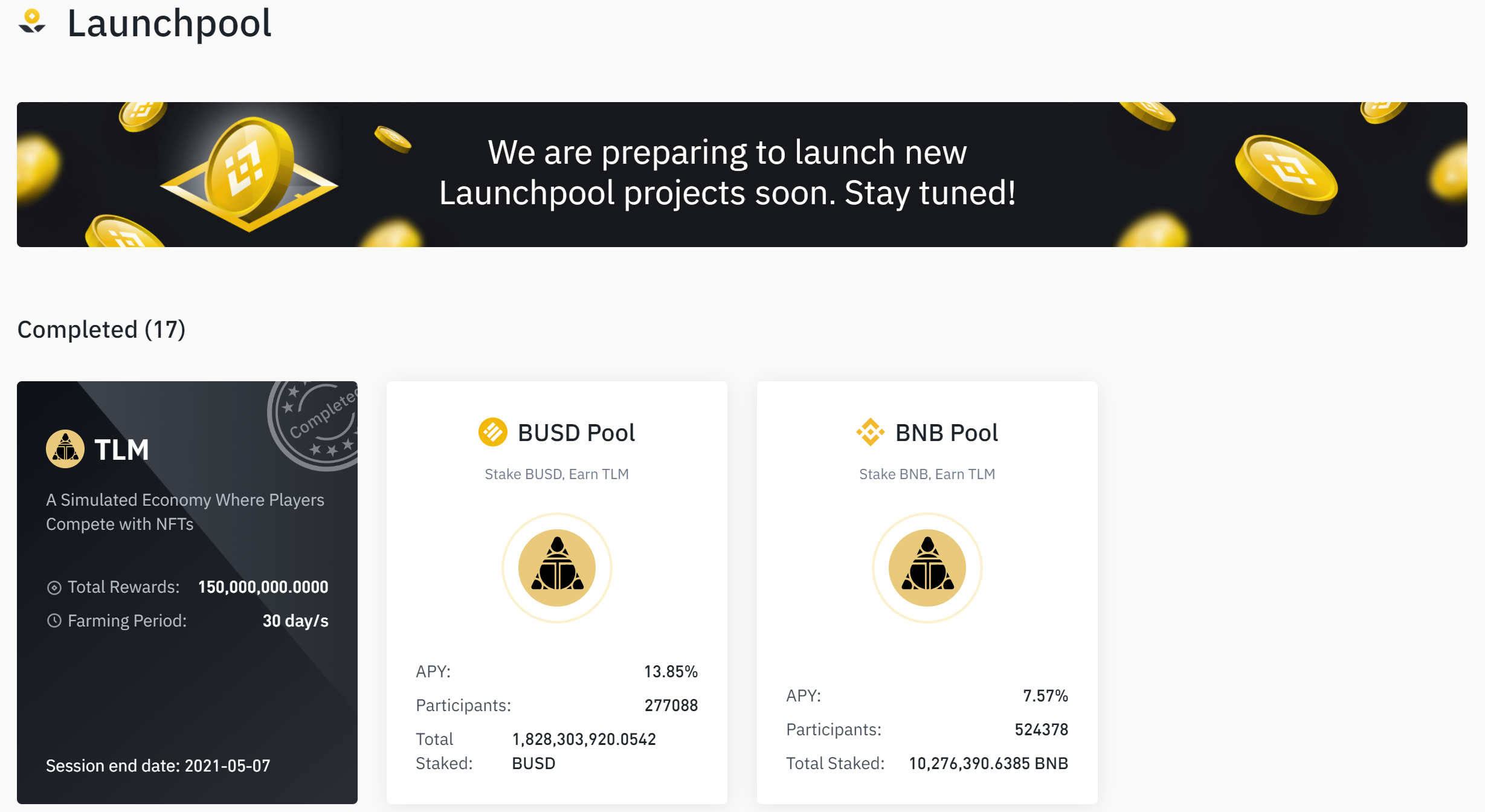

Launchpool

It is a service that allows you to get newly launched virtual currencies.

By depositing the virtual currency offered by Binance, you will be rewarded with a new virtual currency to be launched.

Since the deposited currency can be retrieved at any time, it can be regarded as a type of flexible saving.

It is usually deposited in BNB, BUSD, and other minor currencies.

The current status of the launch pool can be found here.

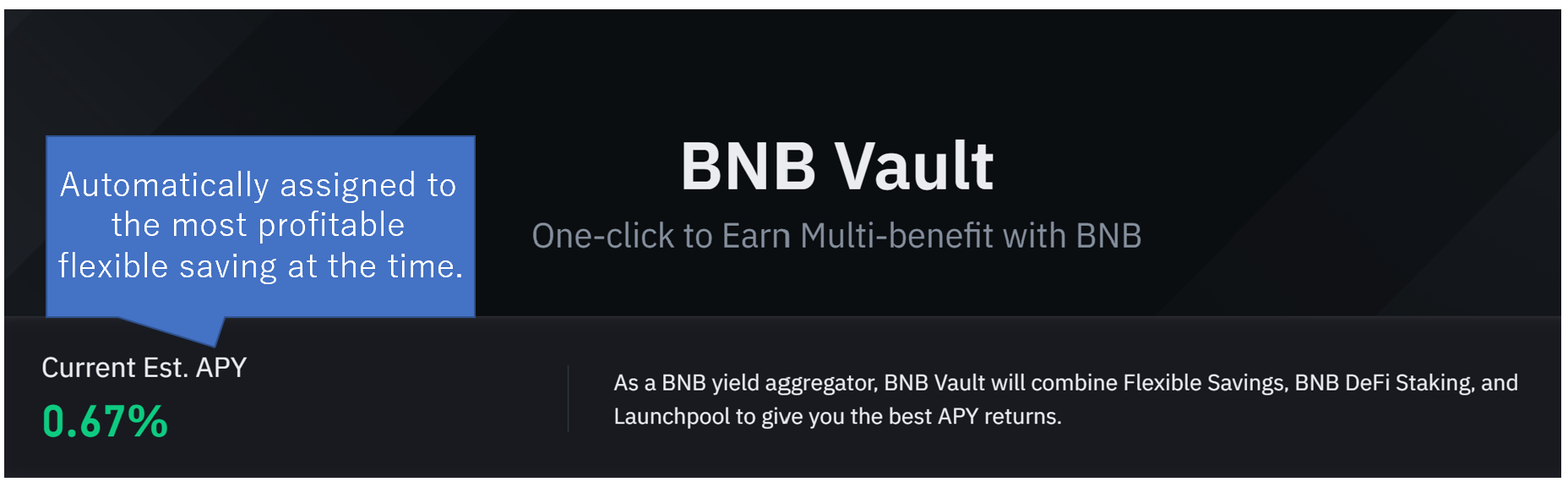

BNB Vault

This is a flexible saving exclusively for BNB, the virtual currency of Binance.

This service will automatically deposit your money into the most profitable flexible savings offered by Binance.

Advantages and disadvantages of flexible saving

This is basically an advantage because you can earn money just by depositing your currency, but it has a disadvantage that the APY (Assumed Percentage of Profit per Year) is lower than other DeFi services.

However, the fact that you can withdraw it at any time is a big advantage since it is practically equivalent to earning money just by holding the virtual currency.

As a comparison to the services I will introduce later, I think it is a balance between the ability to withdraw virtual currency at any time and the rate of return.

Locked Staking

Locked Staking is a service that allows you to deposit virtual currency with Binance for a certain period of time and get paid for it.

The deposited virtual currency cannot be withdrawn until the fixed term has passed.

As a result, you may not be able to take immediate action in situations where you want to sell your virtual currency immediately.

There are times when the value of a currency is plummeting and you really want to sell it.

Currently, the following are available as Locked Staking

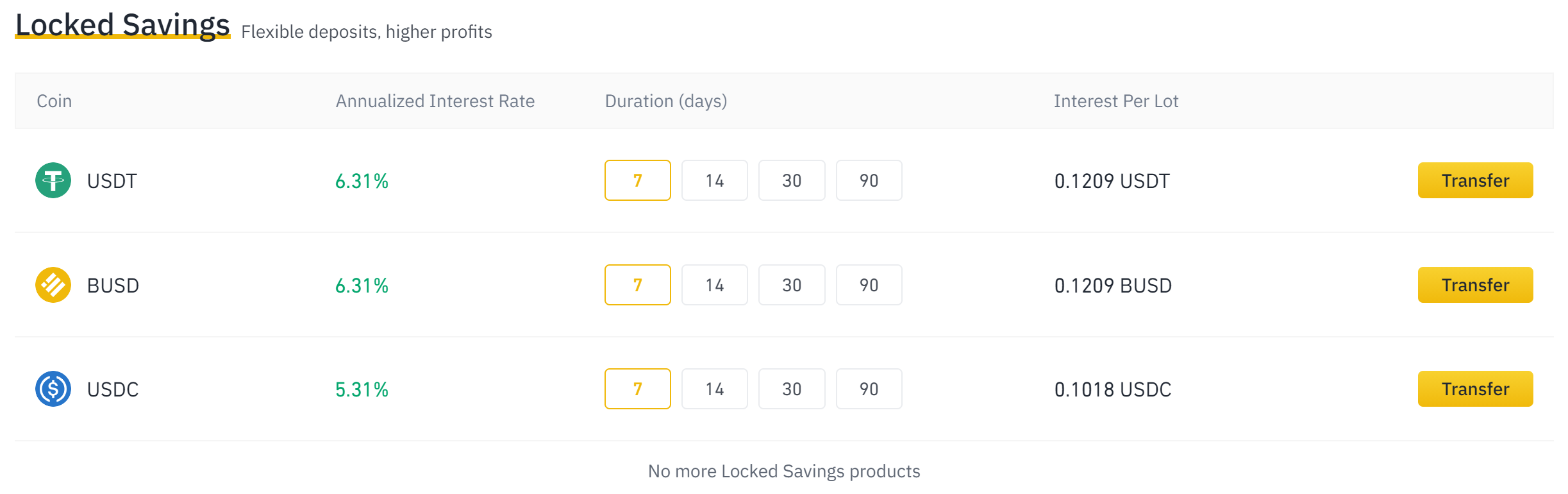

Locked Savings

By selecting a time period and depositing currency for that period, you will be rewarded.

Currently, only USDT, BUSD, and USDC, which are stable coins, can be deposited.

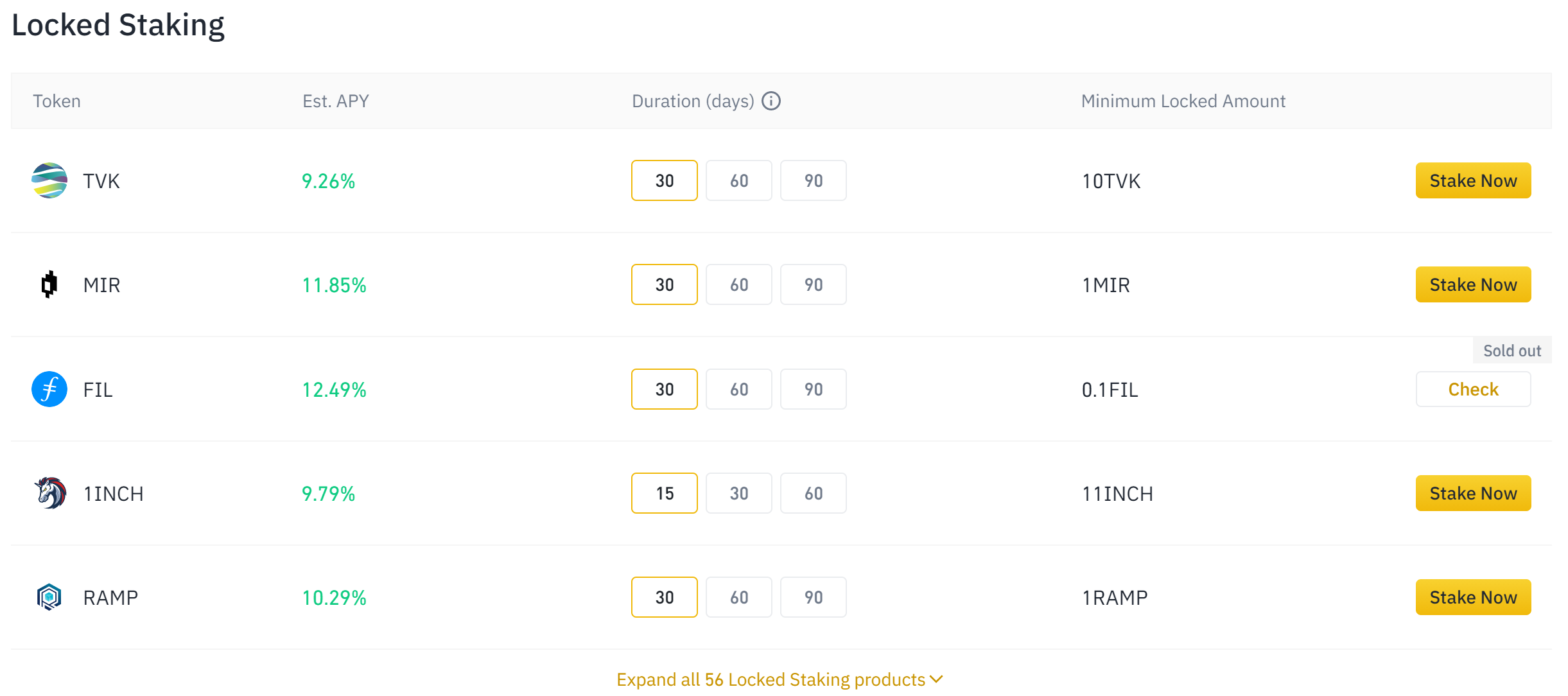

Locked Staking

The difference between this and regular savings is that you can deposit other than stable coins, and there are services with very high APY.

There is a deposit limit for this service, and if it sells out, you will not be able to deposit anything, so the sooner the better.

Currently, 53 currencies can be deposited. The most famous ones are IOST, TRX, and XEM. (Click here to see all available currencies)

Activities

This service has an even lower storage limit than the staking service above.

Many of the APYs are very expensive, and they are usually sold out whenever I see them.

It is also a difficult service to participate in because many of the currencies are not very well known.(Click here to see the currencies)

ETH2.0 Staking

This is a service that allows you to earn revenue from PoS when Ethereum hard forks to Proof of Stake (PoS) in the future.

Since we are currently waiting for a hard fork of Ethereum, we cannot expect PoS income, but we can earn saving rewards for depositing Etherium.

Advantages and disadvantages of Locked Staking

As you may have already been informed, the advantage of regular savings is the high rate of return, and the disadvantage is that it cannot be withdrawn immediately.

The longer the period of deposit, the higher the rate of return tends to be, so you need to determine how long you can keep the deposit.

High-risk Products

High-risk products are services that involve risks other than the increase or decrease in the value of the virtual currency.

Currently, DeFi staking, dual investment, and liquidity swaps fall under this category.

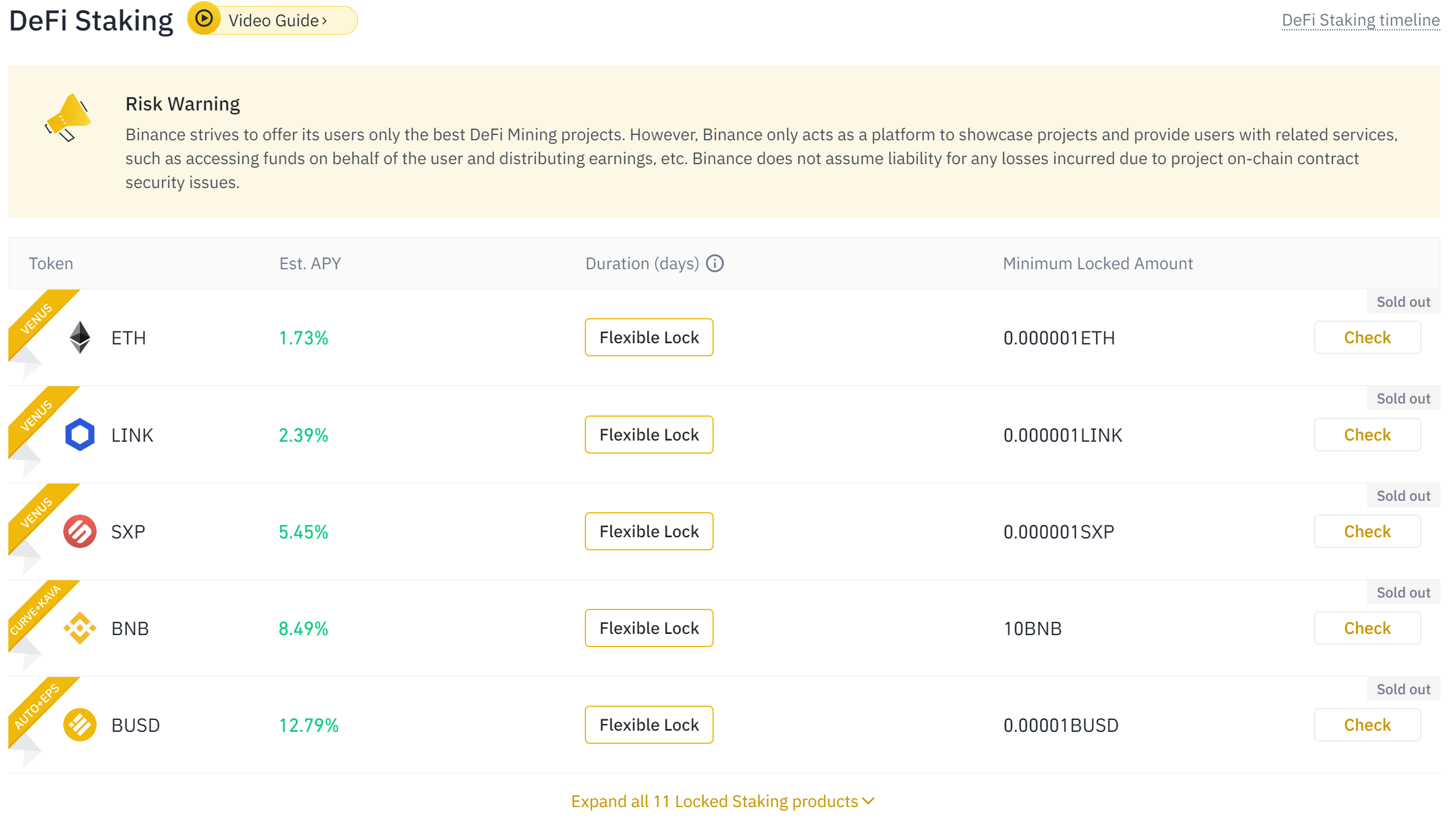

DeFi Staking

You can earn that reward by depositing your virtual currency in DeFi services other than Binance.

Specifically, you can deposit it with a DeFi service such as Compound.

Compound is a virtual currency lending service that allows you to earn interest on virtual currency by lending it to others.

Compound is a fairly well-known DeFi service, and the other DeFi services that Binance has covered were well-known ones.

However, as long as you are lending, there is a risk of bad debts.

Please check here for virtual currencies that can be deposited.

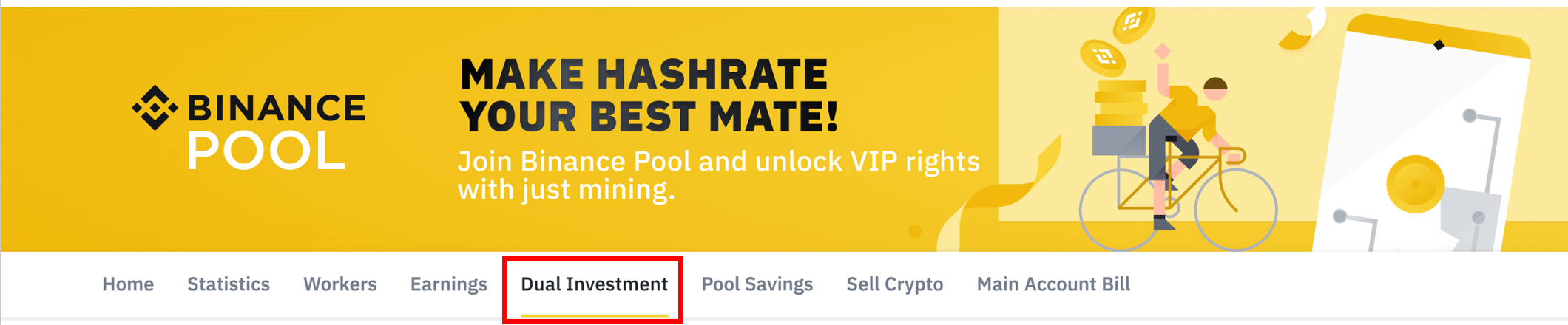

Dual Investment

Dual investment means that you deposit a set amount of currency for a certain period of time, and after a certain period of time, you get the currency you deposited and another currency as a reward.

I’ll include an example from Binance as it is easy to understand.

For example, Bob invested 1 BTC on Binance Dual Investment. The BTC price was $10,000, and he subscribed to a 30-day product with a 40% annual yield. The strike price was set to $12,000.

Binance FAQ

When the product expires 30 days later, Bob will get one of the two outcomes:

Scenario 1: BTC is above $12,000

Bob gets the value of his 1 BTC back in BUSD, plus the interest.

(12,000 * 0.40) / 365 * 30 = 394.5 BUSD

Total received: 12,000 + 394.5 = 12,394.5 BUSD

Scenario 2: BTC is below $12,000

Bob gets his 1 BTC back, plus the 40% annual yield.

(1 * 0.40) / 365 * 30 = 0.03288 BTC

Total received: 1.03288 BTC

One feature is that the APY is fixed.

However, the currency you receive will change depending on whether the deposited currency reaches the strike price or not.

For example, in scenario 1 above, if the price of 1BTC had risen to $12,400, you would have made more money if you had not dual invested.

Also, considering scenario 2, if the value of 1BTC had dropped to $9600, you would have lost money.

If you had not dual invested, you could have sold out when the price started to drop.

I think this is a service that should be used only after carefully considering what kind of situation will lead to profit.

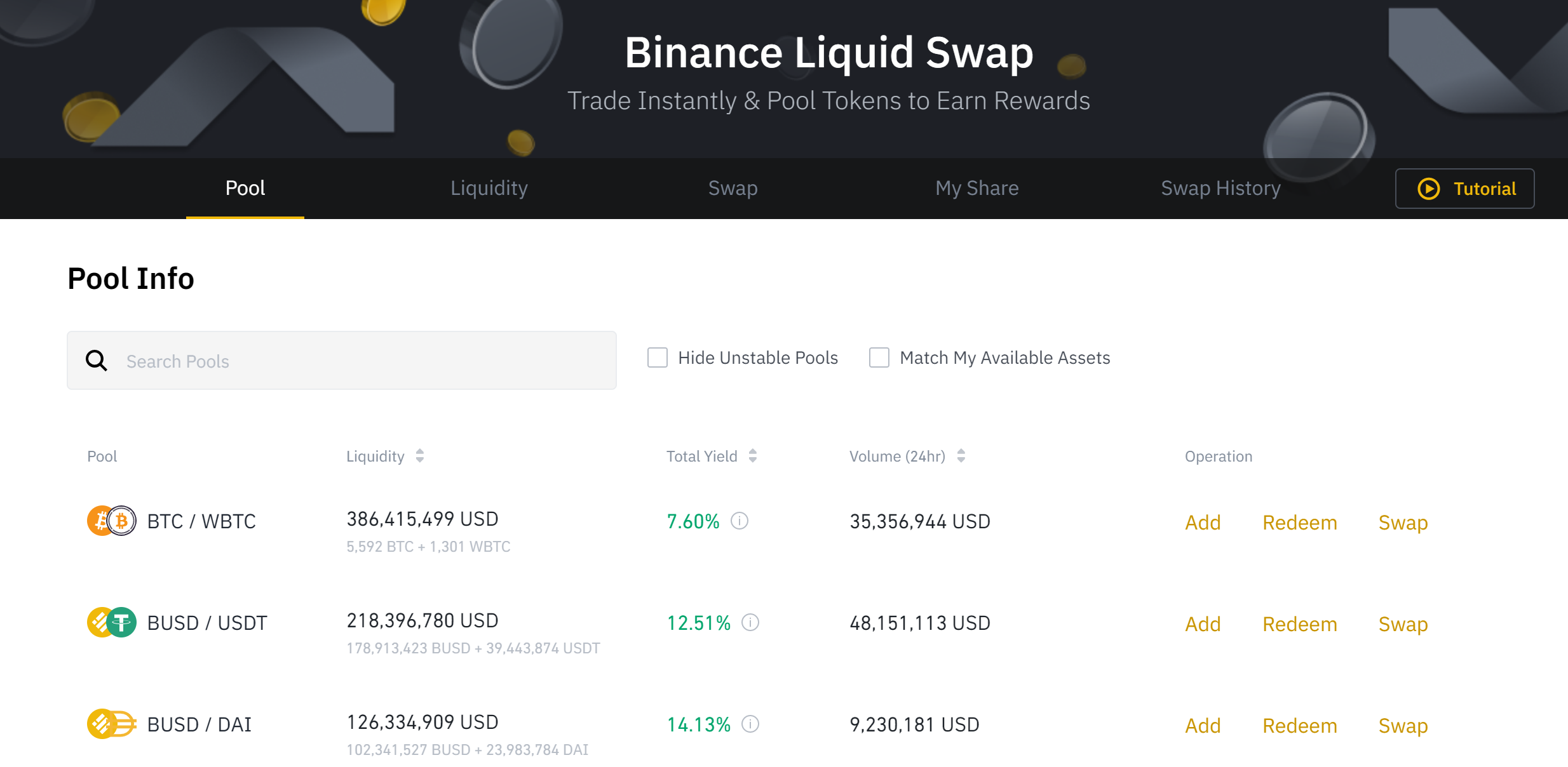

Liquid Swap

Please click here to see the types of currencies that can be deposited.

Liquid swap is a mechanism to earn compensation from exchange users by being a provider of exchange services between two currencies.

The risk here is said to be the risk of impermanent loss.

In Liquid Swap, there is a pool of two currencies called the swap pool.

This pool has a fixed ratio of the two currencies.

For example, if you have a pool of currency A: currency B = 1:1, and you deposit 100 currency A, you will get 50 currency A and 50 currency B each.

If the price of only currency A rises, it would have been more profitable to hold 100 currencies of currency A.

This is an Impermanent Loss.

Binance offers liquid swap on stable coins, a virtual currency pair that is adjusted to be worth about the same as a dollar, so if you use this service, you almost never have to think about impermanent losses.

In Liquid Swap, part of the reward is distributed in BNB (Binance’s virtual currency).

In 2021, we believe that BNB is a good currency to have as it continues to rise.

Advantages and disadvantages of high-risk products

Each of the three services has a different timing, APY (rate of return), and risk for withdrawing currency.

DeFi Staking offers “flexible and fixed term” options, but there is a risk of bad debts.

Dual investment does not allow you to take out a currency for a certain period of time, and the situations in which you can make money are limited.

Liquidity swaps can be taken out at any time, but there is a possibility that impermanent losses may occur for some currency pairs due to the large fluctuation of APY.

You need to take these factors into consideration when deciding which service is best for you.

How to use each service

As you can see, there are many ways to earn money in Binance.

However, you may be wondering how you should use these.

So here is an example of one that I use.

My virtual currency portfolio

I have more stable coins for the above operations and a few other virtual currencies in a diversified portfolio.

The reason for this is that virtual currencies are highly volatile, and I have to be happy and sad every time I look at the chart.

About 80% of my virtual currency is now in stable coins.

The rest is just BNB, ETH, and NEM that I’ve had for a long time.

Examples of Service Usage

Here is an example of how you can make money with these virtual currencies.

BNB:BNB Vault

The BNB has been going up since the beginning of this year.

The BNB is also distributed daily in liquid swap for staple coins.

I believe the reason is that BNB is often consumed in launch pools and the relative number of BNB is decreasing, and I believe the trend will continue to rise.

Therefore, I basically do not intend to sell, but I use BNB Vault, a flexible saving, to sell at any time because of the high volatility.

ETH:ETH2.0 Staking

I’ve also had Ethereum for a long time and don’t have much interest in selling it, so I’m basically leaving it alone.

I am participating in the ETH2.0 staking because I expect that I will have it until the hard fork, and at worst, I can trade in BETH, which Binance provides as an alternative to ETH.

NEM:none in particular

I haven’t found any particular service with a high APY, so I’ve left it alone, but I’m about to sell it.

BUSD, USDT, DAI: Liquid Swap, Locked Staking, DeFi Staking

We aim for high profitability using high-risk products, but we diversify in light of the risks involved.

I check the APY of each service occasionally and reassign them.

The main source of daily earnings are the rewards from the stable coins.

In closing

Thank you for reading to the end.

I hope I have conveyed to you that virtual currencies are not only for trading, but can also lead to profit if managed well.

That’s all.